Have you ever wondered about the differences between a merchant account, a payment service provider, and a payment gateway? Or do you ask yourself which type of them suits your business. Here are some keynotes and a simple breakdown of a merchant account, a payment service provider, and a payment gateway. Stay tuned to find out!

1. What is a merchant account?

In simple terms, a merchant account is like a holding account where all the payments go before being deposited into your typical bank account.

A merchant account plays a role as a special bank account dedicated to receiving payments by online merchants. All the income from your online sales are stored in this account. Whether you sell physical products, subscriptions, or digital products, a merchant account remains the same. It’s just an account to gather the transactions coming from your customers.

The revenue from your merchant’s transactions is being deposited until the settlement date, which is usually once every week. Only then you can receive the funds to your regular accounts.

Now, this is a crucial note to all e-commerce store owners: you can only charge your customers through merchant accounts as only merchant accounts may collect online payments with credit and debit cards (Mastercard, Visa, or Amex).

After successfully applying for a merchant account, you will be assigned a Merchant ID (MID). It is the unique code provided to store owners by their payment processor.

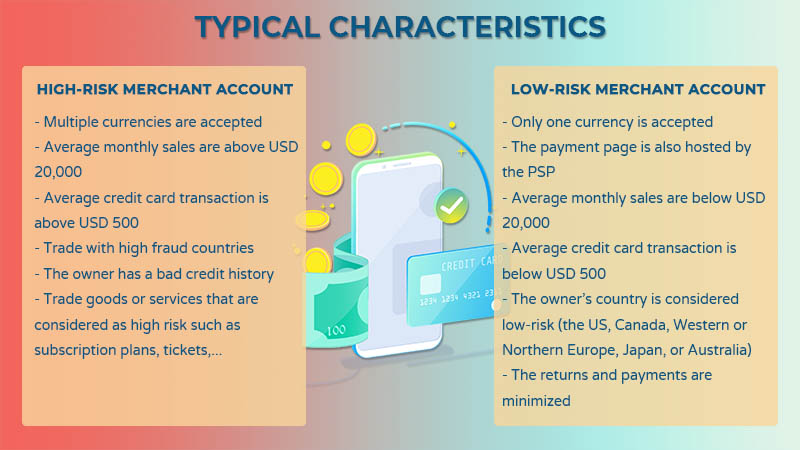

2. What are high-risk merchant account and low-risk merchant account?

Before jumping into finding the ideal merchant service provider, you need to answer some questions beforehand.

Based on criteria that are developed by merchant service providers, your merchant account can fall into either one of the following: High Risk and Low Risk.

If your case falls into the High-Risk category, you must deal with a higher price than that of the Low-Risk Merchants. Besides being charged more, high-risk merchants also have strict contract conditions to minimize any possible risks.

3. What is a Payment Service Provider (PSP)?

PSP is a quick method to accept online payments without the hassle to set up a merchant account.

The PSP operates using a single merchant account with a single MID. Hence, each time a new merchant arises, a PSP just creates a new sub-account within the parent account, aggregating all the other sub-merchants. This is also why some people call a PSP a Payment Aggregator – they aggregate all the transactions from countless different merchants under one single account.

This can be considered as the fastest (and easiest) method to start receiving online payments. However, it also brings some significant disadvantages.

As mentioned earlier, when accepting payments with a PSP, you use a single MID with countless other merchants who are in the same neighborhood on the parent merchant account. And because you all use the same MID, the acquiring could evaluate you as one single merchant. Then, imagine if you ended up in a bad neighborhood with tons of chargebacks, frauds, and refunds, your transaction might be declined and your sub-account might consequently be suspended.

Another significant disadvantage is the lack of customization and flexibility. When you opt for a PSP instead of a merchant account, you usually cannot negotiate the terms and conditions of cooperation. You also can’t negotiate the fees.

The most popular PSP on the market right now are Transferwise, Paypal, and Stripe.

4. What is a payment gateway?

Think of a payment gateway is an interface working on top of a merchant account. It securely collects all the transaction details then passes them to your payment processor or acquiring bank.

When your customers make an online payment, they do not interact with your merchant account, but the payment gateway. In simple words, a payment gateway handles:

- Credit card payment forms on the front end

- Transaction encryption

- Verification systems on the back end

Most merchant account providers come with their own payment gateway. However, if you own a merchant account, then you will have tons of choices among payment gateways.

5. Why should you open a Merchant Account?

Whether to open a merchant account or not lies in the nature of your business. To e-commerce businesses, merchant accounts are as fundamental as the goods themselves.

Setting up a merchant is not as simple as you think. In any case, whether what type of business you are, if you need a merchant account to operate, please consult with an expert or a trustworthy agent. At BBCIncorp, your business and you will be in the good hands of our experts. See more about how to set up a merchant account here.

By now you must get a hold of the three concepts and the ins-and-outs related to each: merchant account vs payment service provider vs payment gateway. It doesn’t matter that you are an e-commerce merchant or other type of business, getting to know and differentiating these concepts is a crucial step to run your business more effectively.

Disclaimer

While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. BBCIncorp would like to inform readers that we make no representation or warranty, express or implied. Feel free to contact BCCIncorp’s customer services for advice on specific cases.

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.