Filing a tax return is applicable to all Belize IBCs deemed tax residents in the jurisdiction. Below is some up-to-date key information about annual tax return filing in Belize.

1. When to file an annual tax return in Belize

Except for IBCs with permanent establishments (PEs) in Belize that must file monthly tax returns, all other resident IBCs are required to file annual tax returns.

2. Belize annual tax return filing procedure

Three main steps for filing an annual Business Tax Return in Belize include:

Step 1

Apply for a Tax Identification Number (TIN) from the Registry. The purpose of this action is for tax authorities to effectively manage the status of the IBC. Normally, it takes about 7 working days to obtain an approved TIN.

Step 2

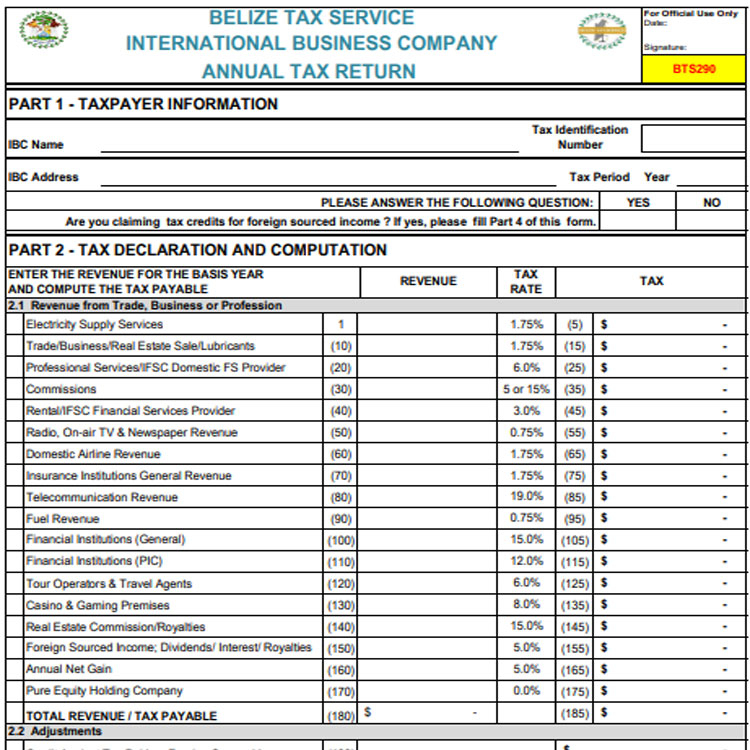

Fill out the IBC Annual Business Tax Form (BTS290) for annual tax return submission. The form consists of 5 parts:

- Part 1 – Taxpayer information: You must provide all requested information such as your TIN, company address, filing date, and so on.

- Part 2 – Tax declaration & computation: You need to declare the annual revenue amount of your business. The form will automatically input the equivalent tax amount based on the applicable tax rates.

- Part 3 – Declaration: This part is to certify the completeness and accuracy of your business tax return filing. You have to confirm your name, position in the company, further sign and date form.

- Part 4 – Tax paid on income from foreign sources: You need to provide a summary of revenue amount, revenue type, and taxes paid in a foreign jurisdiction.

- Part 5 – Annual net gain computation: You will compute the net annual gain using the given formula in the form.

BTS290 sample form

Reminder: Tax payment must be made, and audited financial statements in compliance with IFRS on certain companies can be required to submit along with the form. The companies that are required to submit audited financial statements are:

1. IBCs with receipts of $6,000,000 minimum (U.S dollars); or

2. Any other companies that meet at least two of the criteria below:

- Companies listed on an approved stock exchange;

- Companies regulated by the IFSC;

- Companies that are undergoing a restructure or proposing to sell all of its assets through an auction;

- Companies that are subjected to preparing consolidated financial statements.

Step 3

Submit all required documents and proofs to your registered agent via email.

3. Deadline for first annual tax return

Belize Tax Service Department announced in its latest notice the dates for filing the yearly tax returns of IBCs under grandfathered period and non-exempt IBCs. Accordingly, Belize companies incorporated before 17 October 2017 have no obligation to file their annual returns for the tax period in 2020.

Below table shows the filing deadlines for each group:

| Subject | Tax period | Deadline |

|---|---|---|

| Grandfathered-in IBCs *entities incorporated before 17 Oct 2017 | Jul to Dec 2021 | On/Before 31 March 2022 |

| Non-exempt IBCs | 2020 basis year | On/Before 31 March 2022 |

| 2021 basis year | On/Before 31 March 2022 |

Should you have any questions regarding Belize annual tax return or need further assistance in filing one, feel free to send us your query to service@bbcincorp.com.

Disclaimer

While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. BBCIncorp would like to inform readers that we make no representation or warranty, express or implied. Feel free to contact BCCIncorp’s customer services for advice on specific cases.

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.