Major modifications in the 2021/22 Profits Tax Returns

BIR51, BIR52, or BIR54 are required to file with the Inland Revenue Department as in informed due dates. As being a part of the return, supplementary forms should be submitted together with the return.

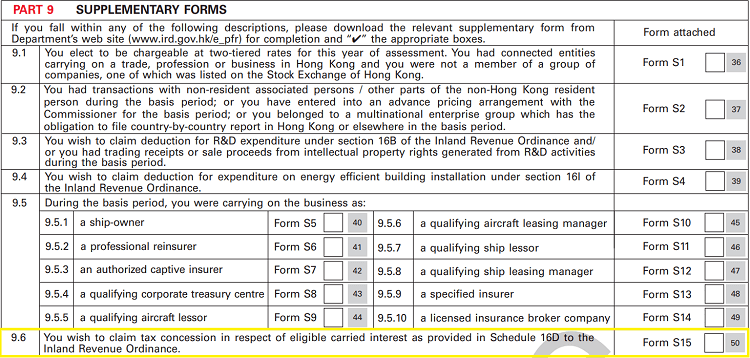

*Supplementary forms are used to declare information on preferential regimes and tax incentives. Taxpayers can download the required supplementary forms and complete the form electronically.

Two major modifications from the IRD you should take into account for the filling Hong Kong profits tax returns this year:

- Tax concession for eligible carried interest

Taxpayers that aim to claim their eligible carried interest arising from Hong Kong investment management services (as prescribed in Schedule 16D to the Inland Revenue Ordinance (Cap.112)) will need to check item 9.6 included in the 2021/22 profits tax returns (particularly in BIR51 and BIR52). At the same time, attaching the Supplementary Form S15 to the return.

- Engagement of service provider to furnish tax return

Another key change in the 2021/22 Profits Tax Returns announced by the IRD is to clarify the confirmation of a service provider’s involvement in preparing the taxpayer’s tax return. The section 51AAD(1) of Inland Revenue Ordinance (Cap. 112) – stipulated the engagement of a service provider in furnishing tax return for or on behalf of the taxpayer.

According to the modification, a service provide would need to:

-

- Sign a tax return for and on behalf of the taxpayer before submitting to the IRD

- Complete the part (Part 13 of BIR51, Part 12 of BIR52, Part 9 of BIR54) where applicable of the tax return

- File along with the the 2021/22 profits tax return the Form IR 1476*

*Note that the confirmation must be retained for a period of at least 7 years from the date on which the Profits Tax return is furnished by the service provider.

The 2021/22 tax filing deadlines under the Block Extension Scheme

Hong Kong profits tax returns together with corresponding supplementary forms normally need to be submitted during 1 month from the issuance date. Due to the application of block extension scheme from Hong Kong government this year, the tax filing deadlines for the 2021/22 profits tax return will be extended.

On 1st April, 2022, the IRD issued over 200,000 profits tax returns for the year of assessment 2021/22 to taxpayers. The upcoming filing deadlines are as follows:

| Accounting date periods | Deadline extension |

|---|---|

| 1st April 2021 to 30th Nov 2021 (N Code Returns) | 30th Jun 2022 (electronic filing to 14 July 2022) |

| 1st Dec 2021 – 31st Dec 2021 (D Code Returns) | 31st Au 2022 (electronic filing to 14th Sep 2022) |

| 1st Jan 2022 – 31st Mar 2022 (M Code Returns) | 15th Nov 2022 (electronic filing to 29 Nov 2022) |

| 1st Jan 2022 – 31st Mar 2022 (M Code Returns with tax loss cases for the year) | 31st Jan 2023 (electronic filing to 31 Jan 2023) |

Disclaimer

While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. BBCIncorp would like to inform readers that we make no representation or warranty, express or implied. Feel free to contact BCCIncorp’s customer services for advice on specific cases.

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.