Vietnam is one of the top destinations for companies with global aspirations. The country’s economy continues its fast growth driven by free trade agreements (FTAs) and an increasingly regulated business environment.

In today’s article, we clarify the pros and cons of doing business in Vietnam, so you can have a better understanding before expanding into Vietnam markets.

1. An overview of Vietnam business environment

In recent years, Vietnam has become one of the most attractive investment locations in Asia, especially for foreigners.

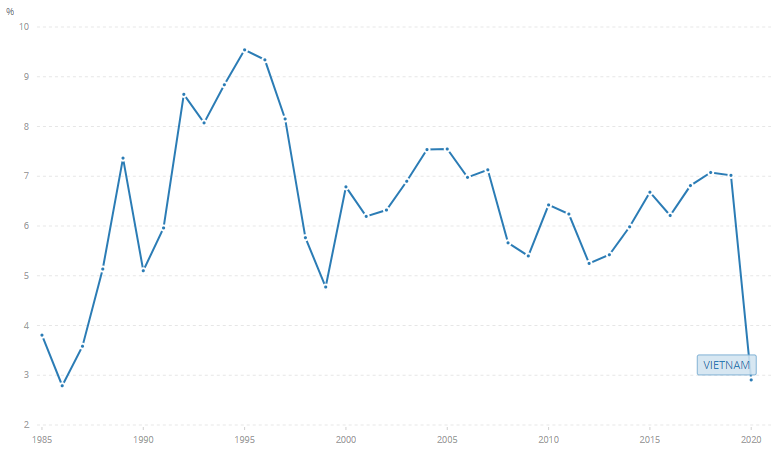

Vietnam’s Annual GDP – World’s Bank

Specifically, some key highlights of Vietnam business environment include:

- GDP growth is at 2.91% in 2020

- Strong purchasing power with a population of over 97 million people

- World’s top factories for supplying electronic items, mobile phones, textile garments, and other industries

- Over 32,539 FDI projects, with total registered capital reaching around US$381 billion

- Duty-free between the EU and Vietnam on several sectors

Along with that, Vietnam has an open business environment that attracts foreign investment.

The country also has a strong position in the IT and manufacturing industry, thanks to competitive labor costs.

In the following section, let’s find out the benefits of doing business in Vietnam in various aspects!

To help you make up your mind, we’ve put together a helpful guide that details all you’ve ever wanted to know about how to start your business in Vietnam as a foreign investor.

2. Advantages of doing business in Vietnam

Starting a business in Vietnam will offer you great benefits. We’ve summarized some key points for you to consider.

2.1. Tax incentives

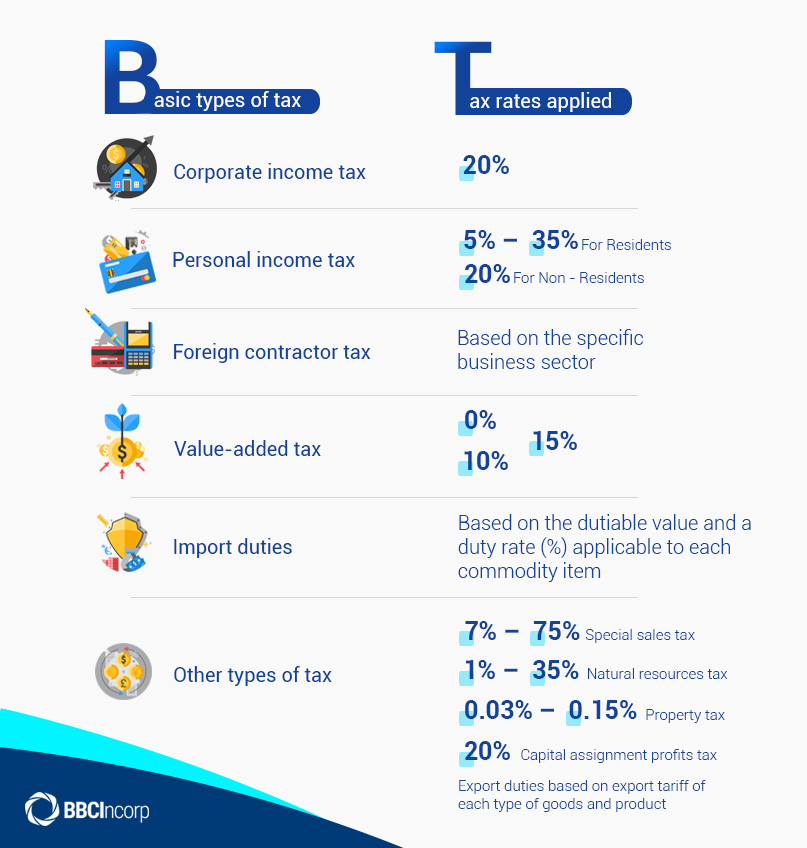

Firstly, you should have basic understandings of the taxes for business operations and investments in Vietnam:

Notably, you can receive some tax advantages for doing business in Vietnam. New investment projects can enjoy tax incentives depending on the sector, location, and scale.

Moreover, if you conduct expansion projects, you’ll be granted CIT incentives if specific conditions are met.

For a full list of taxes you have to pay in Vietnam, just read our article on Vietnam Tax System.

2.2. High-growth economy plus potential market

Vietnam is a dynamic and emerging market with endless potential!

Despite the impact of the Covid-19 pandemic, the country still witnessed an impressive expansion rate, which makes Vietnam relatively stand out among the fastest-growing economies in Asia.

Vietnam’s inflation rate remained under control in 2020 at 3.2%. Compared to its target of 4%, this is a good performance that helps stabilize the country’s market prices.

Developing from a centralized to a market-oriented economy, Vietnam’s purchasing power is measured by a population of 97 million people.

The country also stands in the top 15 countries with the highest population in the world.

Lastly, Vietnam is one of the top countries in terms of growth and development.

In particular, the declaration of EVFTA and the EVIPA in June 2019 has brought positive values for Vietnam’s market as well as foreign investments in the upcoming time.

To know more about your growth opportunities in Vietnam, take a look at our comprehensive breakdown of the EU-Vietnam Free Trade Agreement: A New Door For Vietnam’s Economy, which summarizes a variety of benefits!

2.3. Competitive labor cost

If you’re a foreigner looking to do business in other countries, the labor cost might be one of your concerns.

Starting a business in Vietnam will take this concern out of your head because the labor cost of the country is fairly low and competitive.

Vietnam has a young population and a potential workforce. Remarkably, the country’s average wage cost is more competitive than the neighboring countries like China.

According to statistics, the manufacturing labor cost per hour in China was US$6.5 in 2020, while in Vietnam the cost is only around US$3.

To get a good idea of how to successfully recruit Vietnamese employees, make sure you check out our Guide to Hiring in Vietnam.

2.4. Regulatory framework

Vietnam has put significant efforts to improve its legal and institutional framework.

The regulatory system in Vietnam is supported by an open business environment, transparent investment policies, and favorable profit-based incentives for enterprises.

Generally, the Enterprise Law and Investment Law of 2015 are fundamental laws that govern the incorporation and operation of companies in Vietnam.

These laws have standardized individual’ carte blanche to do business in permitted business areas and reduced a broad array of administrative hassle to enterprises.

Moreover, the private and FDI sectors have received preferable conditions also by virtue of these laws.

The improvement of Vietnam’s regulatory regime has contributed to its ranking internationally.

The country ranks 70th among 190 economies in the World’s Bank Doing Business 2020 report.

In January 2021, Vietnam’s National Assembly has passed the Investment Law and Enterprise Law (Amendment).

Such further updates and changes have made doing business in Vietnam less burdensome and more beneficial for foreign enterprises.

2.5. Strategic location

Vietnam has a strategic location in the center of ASEAN. In addition, it is one of the most prospective economies in Southeast Asia.

Vietnam also shares the boundaries with the Pacific Ocean, Thailand, Laos, Cambodia, and China. This provides Vietnam with favorable conditions for international shipping and trading.

Interestingly, Vietnam’s market also benefits from the shift in China’s supply chains.

The country is close to the manufacturing hub of southern China – one of the world’s largest economies and trading hubs.

Thanks to this proximity, Vietnam has become an attractive destination for investors wanting to access the supply chains from China.

If you want to know more about how Vietnamese culture and customs could potentially affect your business, simply check out our overview of Business culture in Vietnam for more information!

2.6. Vietnam’s free trade agreements (FTAs)

In a global economy, Vietnam has actively entered into free trade agreements. The country signed 15 FTAs with several key trading partners.

Vietnam has also built diplomatic relations with 190 countries worldwide.

Particularly, some of Vietnam’s trade pacts include:

- Japan – Vietnam Economic Partnership Agreement (EPA) (2008)

- Chile – Vietnam FTA (2011)

- Eurasia – Vietnam Economic Union (2015)

- South Korea – Vietnam (2015)

- EFTA (European Free Trade Association) – Vietnam (on-going negotiations)

- Comprehensive and Progressive Agreement on Trans-Pacific Partnership (2018)

- Vietnam – European Union FTA (2019)

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership

- Other Vietnam’s FTAs signed as an ASEAN member nation with Japan, China, India, Australia, and New Zealand, South Korea, Hong Kong

These FTAs have undoubtedly created strong motivation for foreign investors to step into Vietnam’s market.

3. Challenges of starting a business in Vietnam

Doing business in Vietnam goes with some potential challenges.

- High corporate tax rates on some certain investments

Vietnam applies a standard corporate income tax rate of 20% on most corporate entities.

However, in some specific business categories, the tax rate is fairly high.

For instance, if you operate in the exploration and mining of oil, gas, and other natural resources industries, you’ll be subject to tax rates of 32% and 50%, depending on the location and circumstances of the projects.

To get an accurate idea of corporate tax rates for your investment, simply read our Guide to Corporate Tax in Vietnam for Foreigners.

- Restrictions of foreign currency

You’ll need to exchange foreign currency into VND for indirect investment in Vietnam.

Overall, transactions, payments, quotations, advertisements, and other forms alike should be done in Vietnamese currency as well.

However, the inflow of foreign currency into Vietnam has been more open with minimum restrictions. Similarly, transferring overseas has also been less severe.

If you plan to reside in Vietnam for employment purposes, you can transfer your gains abroad if you complete all financial liability to Vietnam’s government.

- Business setup requirements

You’ll need to deal with several requirements to set up a company in Vietnam. For example, the paid-up capital requirement.

Normally, the standard capital for your investment in Vietnam should be at least US$10,000.

Also, depending on the business types, the capital amount can be lower or higher.

The licensing procedure can be quite challenging. Especially if you’re engaging in some conditional sector activities as regulated in Appendix 4 of Law on Investment No. 67/2014/QH13.

Specifically, you’ll have to submit more additional documents like the certificate of business qualification, professional liability insurance, etc.

4. Conclusion

In general, Vietnam is now one of the most prospective markets among ASEAN countries.

The country has gained great achievements in GDP growth, regulatory system, and tax policies to attract foreign investment.

Doing business in Vietnam will open new opportunities for you in different sectors, especially after the huge impacts from the US-China trade war which has led to new waves of investment in the global era.

Disclaimer

While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. BBCIncorp would like to inform readers that we make no representation or warranty, express or implied. Feel free to contact BCCIncorp’s customer services for advice on specific cases.

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.